Your wedding day is one of the most significant moments of your life, and choosing the perfect wedding dress...

Achieving radiant, clear skin naturally starts from within, focusing on holistic wellbeing rather than quick fixes or harsh chemical...

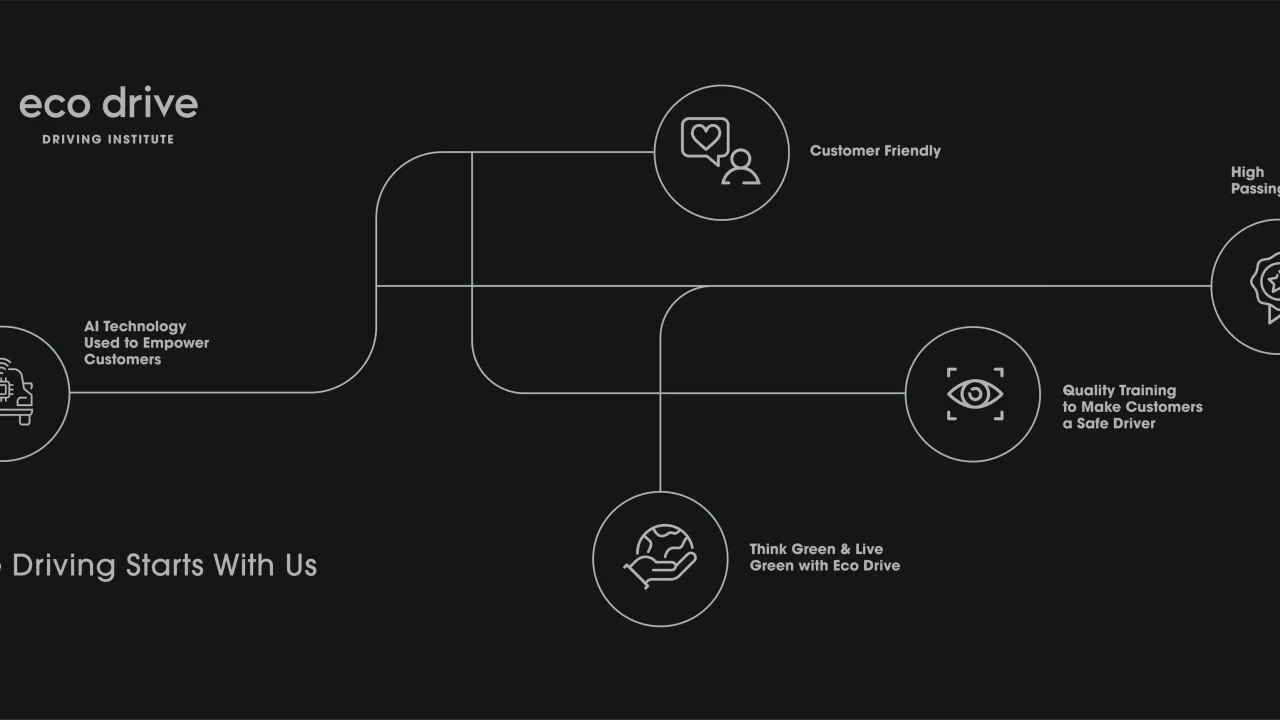

Your first driving lesson marks an exciting milestone on the journey to becoming a confident and capable driver. While...

Photography is a powerful medium for freezing moments in time, telling stories, and expressing creativity. Whether you're a novice...

Dubai, with its vibrant business land and technological advancements, provides an enticing environment for entrepreneurs looking to venture into...

Organic press juices have become increasingly popular in recent years. With the rise of health and wellness trends, more...

The Zoho Attendance Tracker is a powerful tool that helps businesses keep track of their employees' attendance. It provides...

Reverse osmosis (RO) water purification has become a widely adopted technology due to its ability to provide clean and...

Selecting the right stage is a crucial decision that can significantly influence the success of any event. The diverse array...

Planning and executing a successful event require a meticulous approach to staffing. When considering freelance staff for your upcoming...